And if the entire global population of 7.8 billion people all wanted Bitcoin, there’s only enough of the cryptocurrency for 0.0026 BTC to be equally distributed.Ģ1 million BTC distributed equally across just PayPal’s 305 million users alone, would only amount to 0.068 BTC per user.

There aren’t enough for the number of millionaires in the world to one 1 BTC each. Although a mechanism exists that unlocks new BTC to incentivize miners to keep the network churning, the max number of Bitcoin will never increase. Simple Mathematics Highlights The Potential Impact on Bitcoin Supply and Demandīitcoin was designed to be digitally scarce, making the asset a hedge against inflation. But for those that don’t quite understand the impact, comparing these figures to Bitcoin’s maximum supply can be eye-opening. The significance of exposing a substantial userbase to Bitcoin and other cryptocurrencies cannot be understated. The company’s CEO recently told the media that it plans to aggressively grow user accounts of the app to 52 million this year.

#PAYPAL ACTIVE USERS INSTALL#

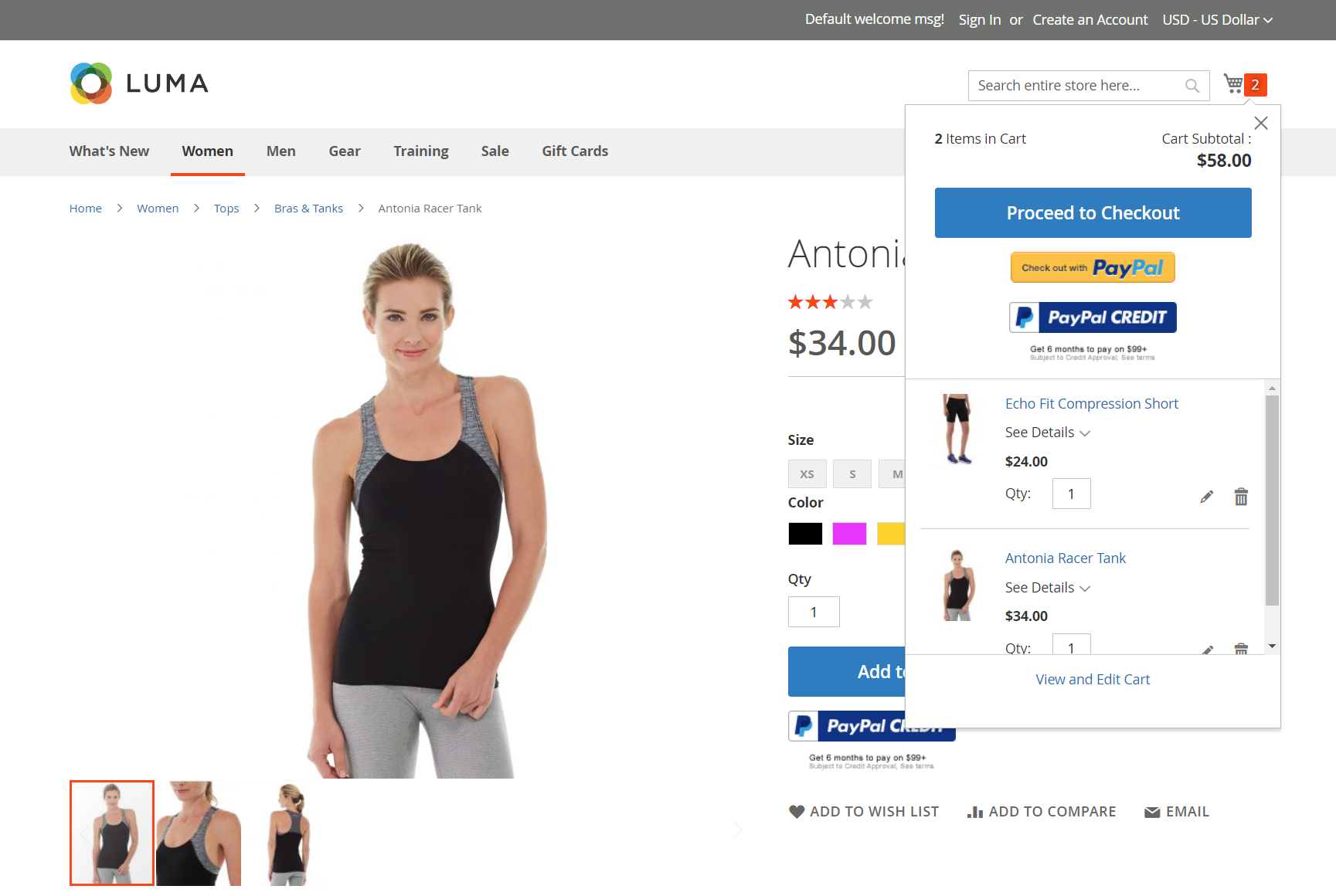

PayPal also recently acquired popular payments app Venmo, further growing its install base of users. PayPal became synonymous with the online auction website eBay in the late ’90s and early ’00s. This number is only bound to grow and has steadily since the company was first founded in 1998. Discussion over the potential impact of the payments processing giant may have on cryptocurrency adoption has spread like wildfire.Īccording to data, there are over 305 million registered and active user accounts on PayPal today. Yesterday, rumors began circulating about a potential move by PayPal and Venmo to support Bitcoin and other cryptocurrencies. PayPal Rumored To Be Exposing 305 Active Users To Cryptocurrencies We’ve done the math to see how the numbers add up and the type of impact that is possible. The enormous installed userbase suddenly having access to cryptocurrencies could be a major boost to adoption. An over 300 million active register accounts on PayPal highlights just how important digital scarcity is to Bitcoin’s value.

0 kommentar(er)

0 kommentar(er)